do you pay sales tax on a leased car in california

Go back to your original lease paperwork and you should find a breakdown of the taxes. This Directive clarifies the application of the sales and use tax statutes GL.

Do You Pay Sales Tax On A Lease Buyout Bankrate

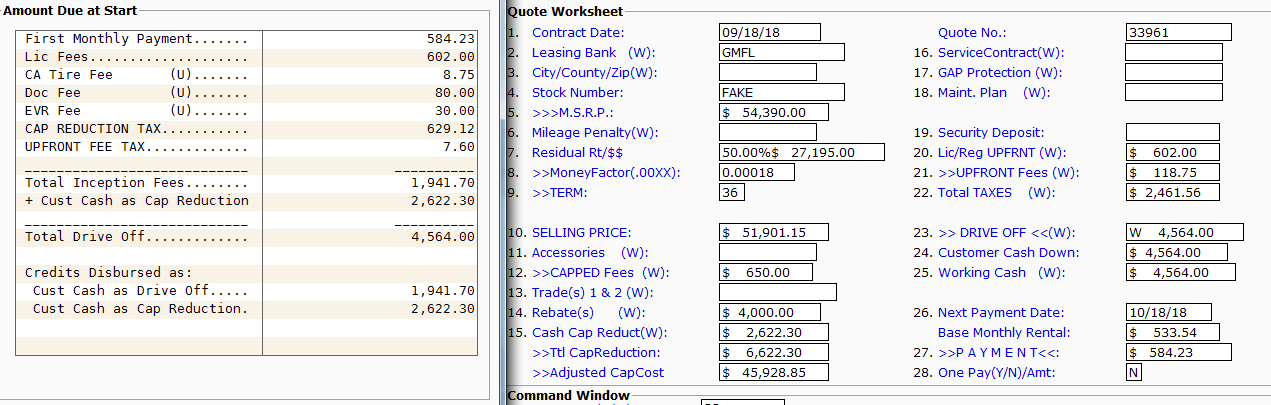

You pay sales tax monthly based on the amount of your payment.

. My buyout is 15500 and I have a friend who has offered me 23500 for it. When you lease a car in most states you do not pay sales tax on the price or value of the car. Do I have to pay sales tax on a gifted car in California.

This protects people who lease from having a spike in how much they. My lease for a 2019 Hyundai Ioniq Electric Limited Trim is up on Nov. In others youll have to pay sales tax on the entire capitalized.

If the residual value is 20000 tax rate is 6 you will pay 1200 in sales tax. Email your questions to. In most cases yes youll still have to pay sales tax when you lease a new car but this could vary depending on where you live.

Of this 125 percent goes to the applicable. At the very least you have likely already paid some sales tax on the car so its highly unlikely you need to pay taxes on the complete original price of the leased car. Some states such as Montana and New Hampshire dont have a sales tax.

64I and the Departments sales tax regulation on Motor Vehicles 830 CMR. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. The title must have the word gift entered on it instead of.

According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. On the subsequent lease. The buyer must pay sales tax to the california department of motor vehicles upon registration of the vehicle.

In some places youll have to pay sales or excise tax on the amount you put down plus your monthly payments. In California a commission is a type of compensation paid to a person for sales-related services they render. While you wont necessarily pay the entire.

You dont need to pay the tax to the dealer or private party when buying the used car but you do need to pay it when you register the vehicle in your home state. This means that you would only pay taxes on the 6000 you paid and not on the total value of the car. Use tax is due.

When you lease a vehicle you will pay a use tax in most states. This means that you pay sales tax on the monthly payment not on the selling. Since the lease buyout is a purchase you must pay your states sales tax rate on the car.

No you do not have to pay sales tax on a vehicle given as a gift or inheritance. You may not only have paid some sales tax on the car already but possibly all of it. As long as the customer has proof the sales tax was paid they will not have to pay the sales tax again a Motor Vehicle Commission spokesman said.

When you purchase a car you pay sales tax on the total price of the vehicle. In a commission-based arrangement the size of the employees. Do You Pay Sales Tax On A Leased Car In California.

If you purchase or lease a vehicle you may be liable for a 68 percent sales tax. Some Washington residents can obtain a partial or full sales-tax exemption on new electric vehicles. Local governments such as districts and cities can collect.

The sales tax for car-lease payments is based on the sales tax of the state where the car is leased at the time of the lease. Instead sales tax will be added to each monthly lease payment. For example if you RENT a 20000 car with an estimated resale value of 13000 after 24.

In these cases youll only be responsible for the lease payments and wont have to pay any additional taxes. Well if you currently live in California then yes. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off.

How do I buy out my. Selling Lease Buyout CA Sales Tax. Sells the vehicle within 10 days use tax is due only.

California Sales Tax on Car Purchases.

What To Know About Los Angeles Auto Sales Taxes And Fees

Sales Tax And Leasing Transactions Brotman Law

California Lease Tax Question Ask The Hackrs Forum Leasehackr

What S The Car Sales Tax In Each State Find The Best Car Price

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

How To Negotiate A Car Lease Credit Karma

How Does The Inventory Shortage Impact Leasing News Cars Com

Massachusetts Auto Sales Tax Everything You Need To Know

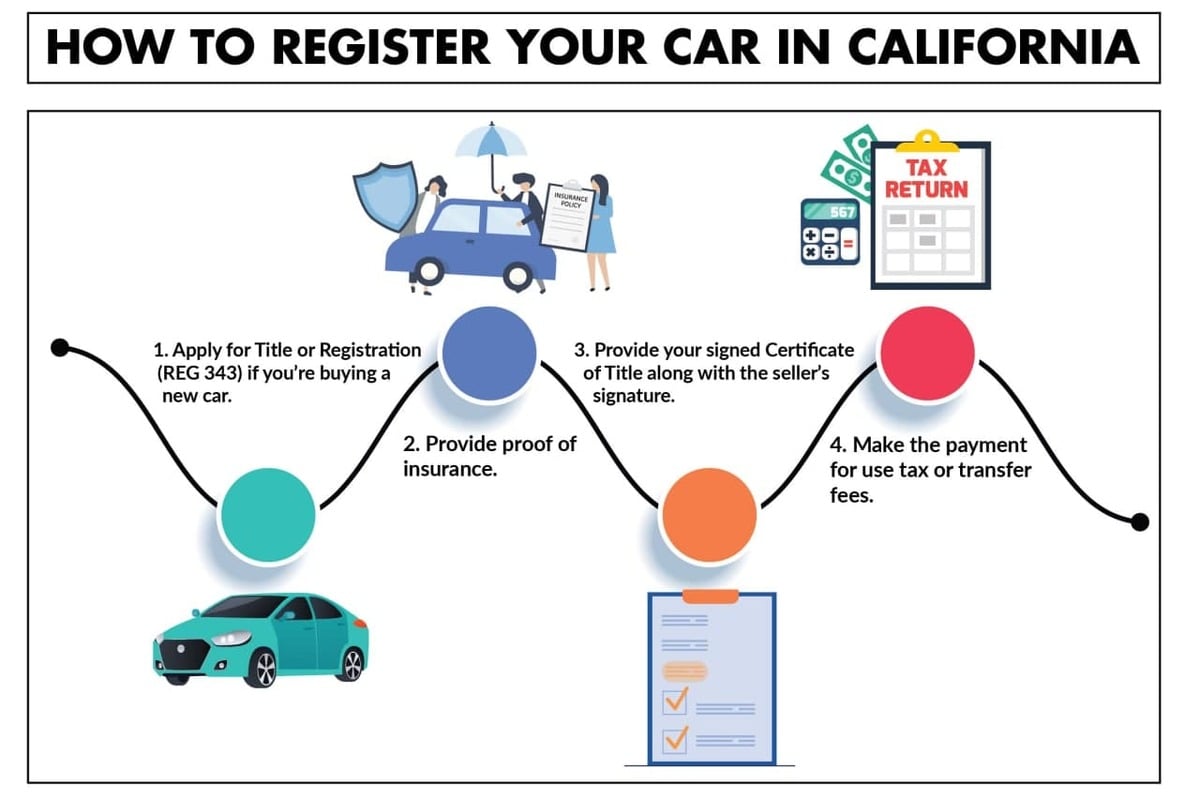

Moving To California Driver S License And Car Registration

Nissan Lease In Glendale Ca Glendale Nissan Nissan Lease Specials

Leasing A Car And Moving To Another State What To Know And What To Do

What S The Car Sales Tax In Each State Find The Best Car Price

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

Should I Buy An Out Of State Car Edmunds

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Sales And Use Tax Regulations Article 11

New Volkswagen Specials Vw Lease Deals Rebates Incentives